The Ultimate Guide To Offshore Company Formation

Table of ContentsThe Basic Principles Of Offshore Company Formation Getting The Offshore Company Formation To WorkFacts About Offshore Company Formation UncoveredGetting My Offshore Company Formation To Work

Hong Kong permits development of overseas companies and offshore financial institution accounts if your business does not trade in Hong Kong region. Also, in this situation, there will certainly be no company tax used on your earnings. Offshore firms in Hong Kong are attractive: steady jurisdiction with outstanding online reputation and a dependable overseas banking system.

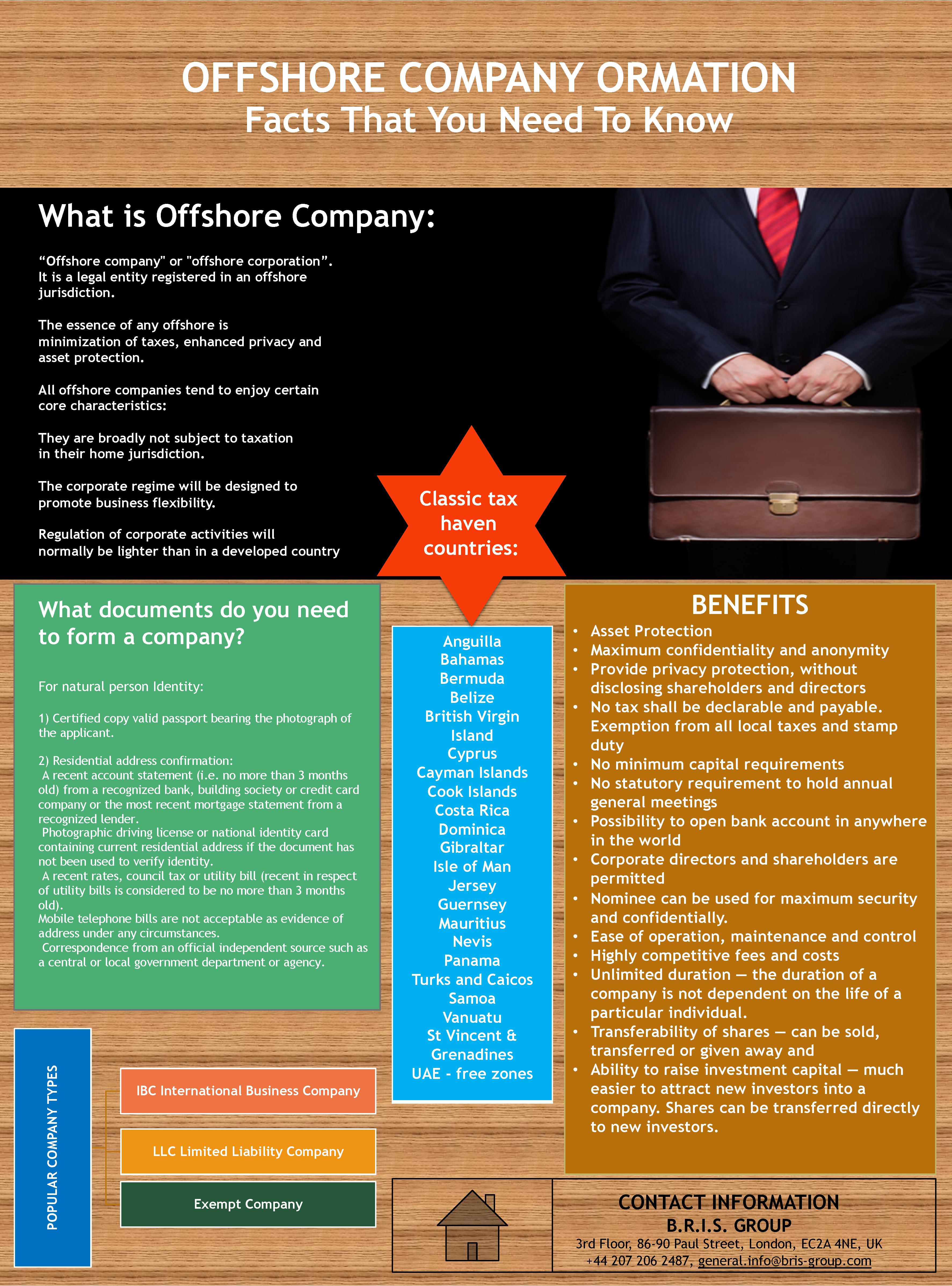

There are no clear distinctions due to the specific company laws of each country, normally the major distinctions are tax obligation structure, the degree of discretion and asset security. Lots of nations wish to bring in foreign business and also capitalists by introducing tax legislations friendly to non-residents and global companies. Delaware in the United States as an example is traditionally among the largest tax obligation places on the planet.

Offshore tax obligation havens are typically labelled as a method for tax evasion. This is usually because of their stringent privacy and possession defense laws as they are not obliged to report or disclose any info to your nation of residence. Nonetheless, that does not suggest you do not have to comply with regulations where you are resident in terms of monetary reporting obligations.

Not known Factual Statements About Offshore Company Formation

The term offshore describes the company not being resident where it is formally integrated. Frequently extra than not, the directors as well as other participants of an offshore business are non-resident additionally contributing to the company not being resident in the country of enrollment. The term "offshore" might be a little bit complicated, due to the fact that a number of modern monetary centres in Europe, such as Luxembourg, Cyprus and also Malta provide global company entities the very same benefits to non-resident companies as the traditional Caribbean "tax obligation places", but commonly do not make use of the term offshore.

That does not imply you do not have to adhere to regulations where you are resident in terms of economic coverage commitments. The discretion by having an overseas firm is not concerning hiding possessions from the government, but regarding privacy and also protection from unwarranted claims, risks, spouses as well as various other lawful conflicts.

The term offshore as well as confusion bordering such companies are usually related to outrages. Offshore business act like any kind of normal business however are held in different territories for tax obligation objectives therefore giving it benefits. This does not mean it acts illegal, it's merely a method to optimise like it an organization for tax as well as protection objectives.

The Offshore Company Formation PDFs

These are frequently limiting requirements, high expenses as well as disclosure plans. Anybody can begin a company, not every can obtain the very same advantages. The most typical benefits you will find are: Easy of registration, Marginal charges, Adaptable administration and very little coverage demands, No international exchange restrictions, Beneficial neighborhood business legislation, High privacy, Tax obligation benefits, Minimal or no constraints in regards to service tasks, Relocation possibilities Although it actually depends upon the legislations of your country of house and exactly how you wish to optimize your organization, usually on-line services and also anything that is not depending on physical facilities usually has the greatest benefits.

Activities such as the below are one of the most common as well as valuable for overseas enrollment: Offshore financial savings and also financial investments Foreign exchange and also stock his explanation trading, Shopping Specialist solution business Net services International based firm, Digital-based Firm, Global trading Ownership of copyright Your country of home will inevitably specify if you can become completely tax-free or not (offshore company formation).

This list is not exhaustive as well as does not always apply to all territories, these are normally sent out off to the enrollment workplace where you desire to register the firm.

is a business which only executes economic tasks outside the country in web which it is registered. An overseas company can be any kind of enterprise which doesn't operate "at residence". At the exact same time, according to public opinion, an offshore firm is any enterprise which enjoys in the country of registration (offshore company formation).

Not known Factual Statements About Offshore Company Formation

Establishing an offshore business appears difficult, however it worth the initiative. A common factor to establish up an offshore company is to fulfill the lawful demands of the country where you intend to acquire home. There are lots of offshore territories. We always seek to locate. They all satisfy the very high criteria of, which are basic components in picking your offshore area.

Due to the fact that discretion is just one of one of the most important elements of our work, all details entered upon this type will be maintained strictly confidential (offshore company formation).

Also prior to going into information on how an overseas business is created, we initially need to comprehend what an overseas business truly is. This is a company entity that is developed as well as runs outside your nation of home. The term 'offshore' in money describes commercial techniques that are situated outside the proprietor's national boundaries.